Springly vs. QuickBooks

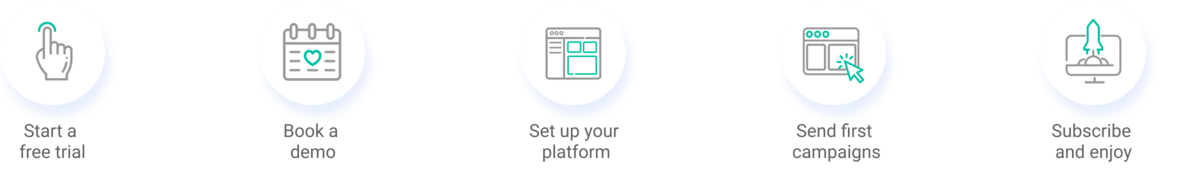

How does QuickBooks compare to Springly, Bloomerang, Little Green Light, MemberClicks, and Wild Apricot? 14-day free trial - No hidden fees

Our honest opinion...

The biggest difference between Springly and QuickBooks is the 'all-in-one' element. While QuickBooks is an entirely accounting-oriented product, Springly takes its roots in the nonprofit sector, covering a more diverse range of features. This difference in market position brings about a whole load of differing benefits for each product. Ultimately, deciding which is the right software for your organization will depend on how you intend to use it - let's take a deeper look!

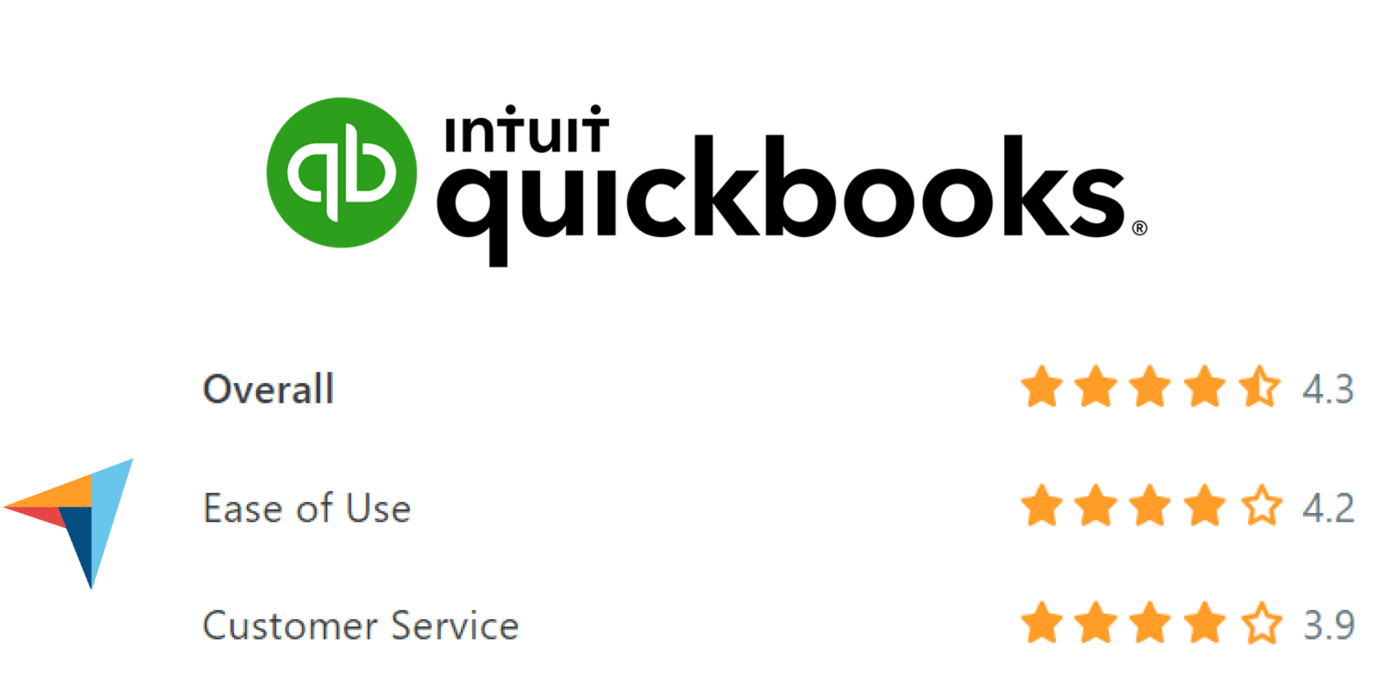

There's no doubting that QuickBooks is a veteran of the accounting space. Having spent years accruing new customers with new needs, QuickBoooks have cultivated an extremely sophisticated product with many advanced features, such as smart reporting integrations. The downside of this, however, is that QuickBooks can quickly become overwhelming for the non-expert or part-time bookkeeper. Just like that, it positions itself perfectly as an accounting management software for small businesses and consultants, where a typical user has some form of accounting background.

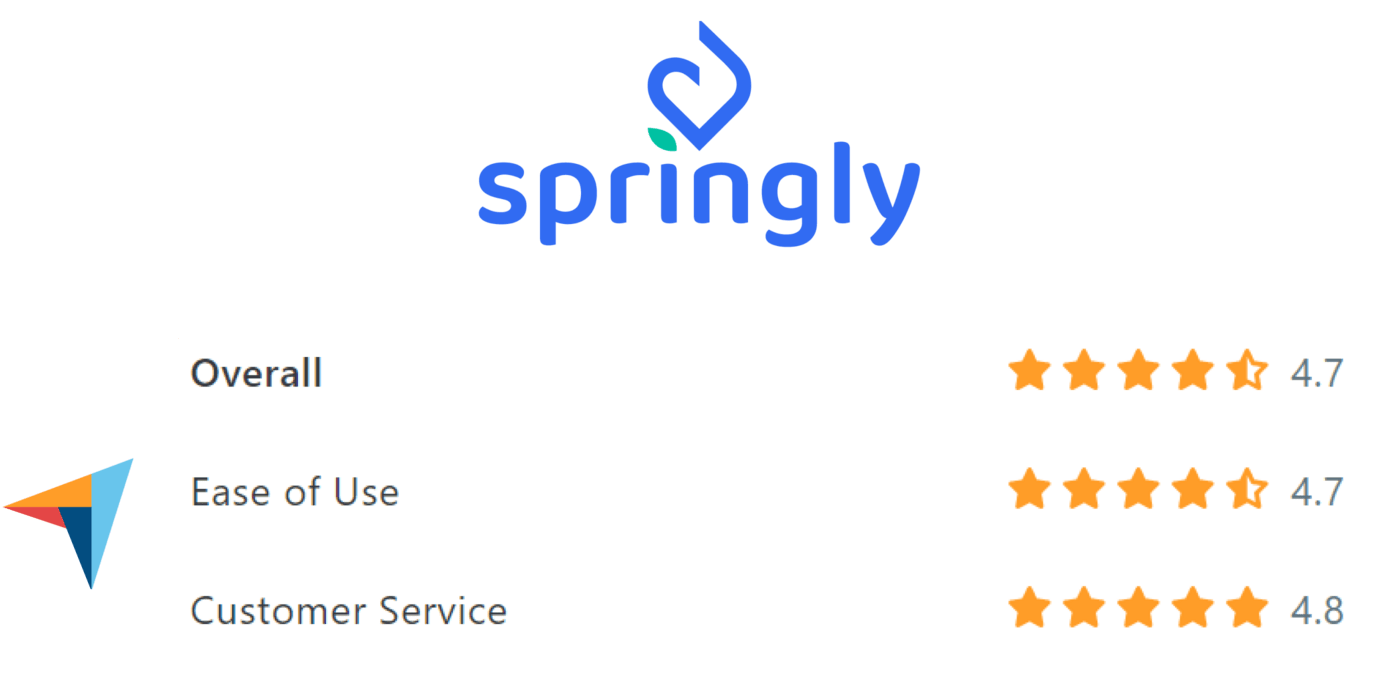

You can think of Springly as QuickBooks' younger, fresh-faced sibling, trimmed and refined to fit the needs of nonprofits. While this may mean Springly's accounting suite lacks some of the more technical elements that QuickBooks offers, it presents a new window of opportunity by way of simplicity, making it ideal for use by the non-expert. Another point to consider is that, being an all-in-one software, Springly offers other features alongside accounting. In this way, you can set-up and manage online payments for your upcoming fundraising event, knowing that accounting entries will be automatically generated for each purchase. That being said, Springly still recognizes QuickBooks as a huge player in the accounting space. By offering clients a QuickBooks integration, the transition process is made a whole lot easier for those looking to adopt a simpler, nonprofit-oriented software.